Lending Built for Builders AnD Developers

We specialize in project financing for developers and builders. Our experience in development and homebuilding enables us to deliver creative and competitive solutions while meeting project timelines.

talk with us$800M+

loans originated

2M+

sq ft developed

10,000+

lots sold

25+

years of experience

Strategic Capital for Local and Regional Developers and Builders

Experience and Market Knowledge

While we have more than $1 billion in assets under management, we don’t just underwrite loans. We are partners who support your success. AREC is affiliated with Builder Advisor Group, a leading investment bank in the industry with extensive knowledge of regional markets. Our experience and market knowledge enables us to structure capital solutions that are tailored and responsive to the realities of your business.

Fast, Streamlined Decision-making

Our team handles originating, underwriting and servicing for all loans. This vertically-integrated approach allows us to meet your project timelines without bureaucracy.

Flexible Capital Tailored to Your Project

Each project has unique requirements. Our team has decades of experience developing land and building homes. We use this knowledge and experience to devise creative and responsive terms tailored to your project's realities.

.jpg)

credit

AREC’s lending platform offers flexible financing for Acquisition, Development, and Construction (“AD&C”) to homebuilders and developers across the nation.

equity

We invest in entitled land and residential development projects throughout the Sun Belt states.

advisory services

Builder Advisor Group ("BAG") is the established Investment Banking leader in residential real estate, providing M&A advisory and capital raising solutions to homebuilder and developer clients.

Notable Projects Funded

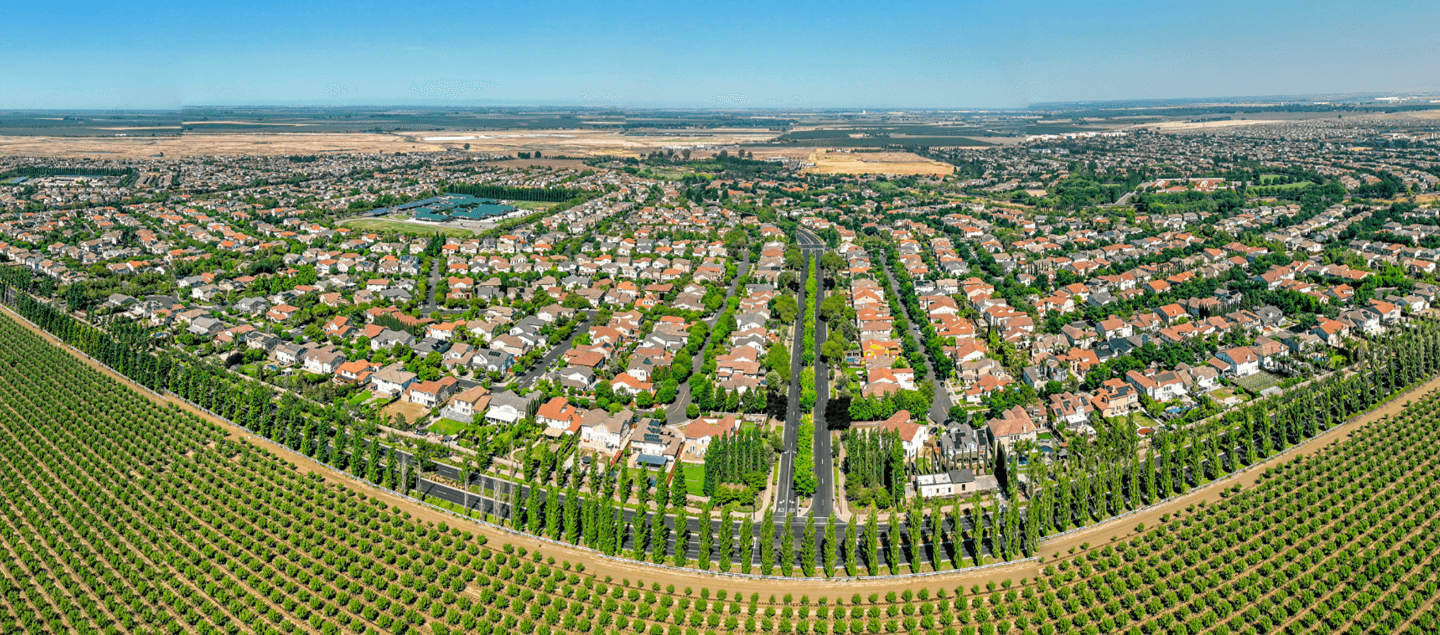

Avila Real Estate Capital has funded more than $800 Million in acquisition, development and construction (AD&C) financing that have resulted in more than 10,000 lots that have sold for developers.

$8,000,000

Financing for acquisition and development of 205 lots in Winnabow, North Carolina

$362,000,000

Financing for the acquisition of 5,500 lots in Mountain House, California

$21,000,000

Financing for acquisition of 129 acres for development of 419 lots in Fulshear, Texas

$20,700,000

Financing for acquisition and development of 170 lots in Mt. Dora, Florida.

Project Criteria for Funding

Advance Rates

- Up to 100% construction LTC

- Up to 80% - 85% development LTC

Competitive interest rates

Loans Sizes from $10 million up to $300 million

Types of Financing

- A&D project or borrowing base financing

- Vertical project financing

- From single projects to master-planned communities

- Revolving builder lines for multiple projects/subdivisions/MPCs

Creditworthiness

- Financial strength: low leverage, strong liquidity & cash flow, solid equity and margins

Regional Considerations

- Strong primary or secondary markets with an emphasis on strong population and job growth with a positive economic outlook

- Current target markets include:

- West (California, Oregon, Washington, Idaho, Arizona, Colorado)

- Central (Texas)

- Southeast (Florida, Georgia, Alabama)

- Mid-Atlantic (South Carolina, North Carolina, Virginia, Maryland)

Target Client:

- Top 25 production homebuilders/developers in primary or secondary markets, focusing on financial strength

- Track record of successful projects/subdivisions/MPCs

- Builders: From 100 to 2,500 annual closings.

- Developers: From 75 to 1,000 annual lot deliveries